What Is Form 8586: Low-Income Housing Credit - TurboTax Tax Tips

By A Mystery Man Writer

General business tax credits provide incentives for business activities beneficial to the American public or the economy in general. Owners of rental buildings in low-income housing projects may qualify for the low-income housing credit, which is part of the general business tax credit, using Form 8586 to calculate the amount of the credit.

Housing Benefit Self Employed Factory Wholesale

Free Tax Filing, File Simple Federal Taxes Online for Free

Low-Income Housing Tax Credit (LIHTC)

3725 N Sherman Dr, Indianapolis, IN 46218 Trulia, 43% OFF

Your Federal Income Tax For Individuals, IRS Publication 17, 40% OFF

2007 TurboTax Home & Business Federal Turbo Tax NEW CD sealed in original sleeve - Renzi Ceramiche

What Is Form 8586: Low-Income Housing Credit TurboTax Tax, 59% OFF

3725 N Sherman Dr, Indianapolis, IN 46218 Trulia, 43% OFF

What Is The Earned Income Credit? Find Out If You Qualify, 54% OFF

2009 turbotax Home & Business Estado federal + + 5 efiles intuit Turbo impuestos : Todo lo demás

TurboTax Premier Federal + State + Federal efile 2009 : Everything Else

Your Federal Income Tax For Individuals, IRS Publication 17, 40% OFF

- Children of Low-Income Families

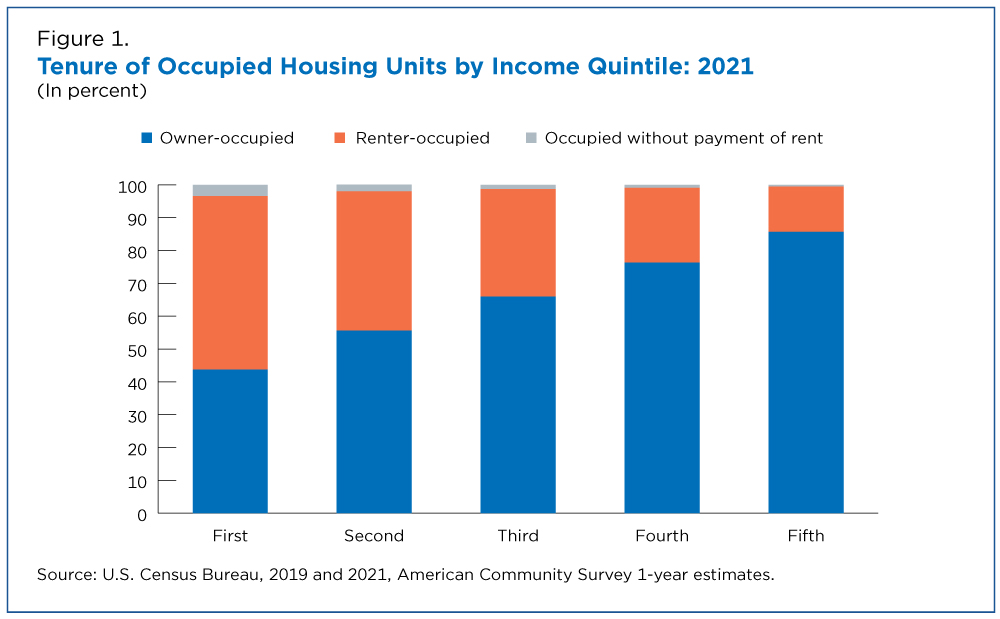

- Low-Income Renters Spent Larger Share of Income on Rent in 2021

- How to Reduce Inflation-induced Costs for Low-income Families - Route Fifty

- National Low Income Housing Coalition

- There Doesn't Go the Neighborhood: Low-Income Housing Has No Impact on Nearby Home Values - Trulia Research

- Buy AAYAN BABY Night Wear Undergarments Women Unique Comfort and Stylish Small Size Red Thongs Panty - 04145S-RD at

- Find Out Where To Get The Pants Elegant pants outfit, Trousers

- BDG Cargo Jogger Jean

- Victoria's Secret Body by Victoria 36DDD bra Size undefined - $20 - From Ava

- Young caucasian woman posing in blue bra and jeans. Stock Photo