HSA Eligible Expenses

By A Mystery Man Writer

DataPath helps TPAs get where they want to grow through innovative solutions for CDH accounts, COBRA, billing, and well-being benefits.

Since they were enacted in 2003, Health Savings Accounts (HSAs) have become an integral part of the consumer directed healthcare landscape for those with a high deductible health plan. One of the chief benefits of having an HSA is that account holders can use that money to pay for a wide range of eligible medical expenses for themselves, their spouses, and their tax dependents.

HSA Eligible Expenses 2023: What expenses can you use your HSA for?

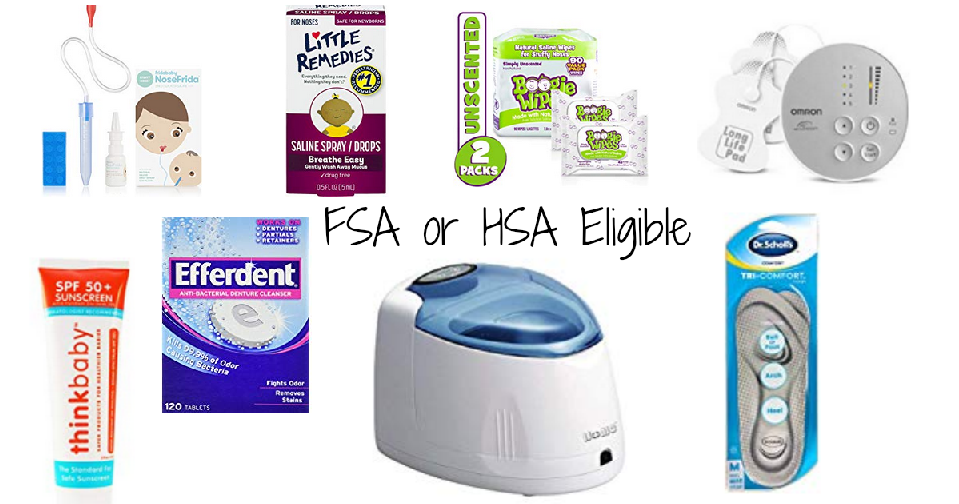

16 Surprising FSA and HSA Eligible Expenses Your Employees Should Know About

HSA Qualified Expenses - UMB by The MJ Companies - Issuu

Eligible Expenses for HSA FSA and HRA

Health Savings Account HSA Eligible Expense Guide 2024

Are You Maximizing the Benefits of Your HSA? - Harvard Pilgrim Health Care - HaPi Guide

How to Use Your HSA for Dental Savings

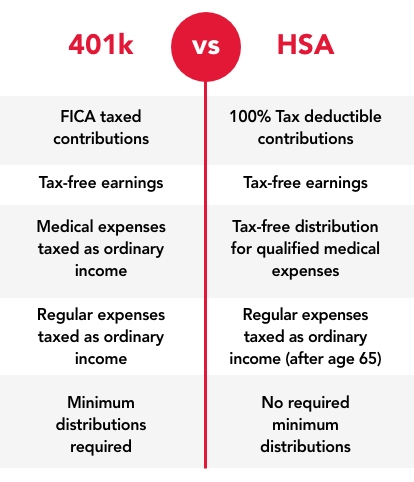

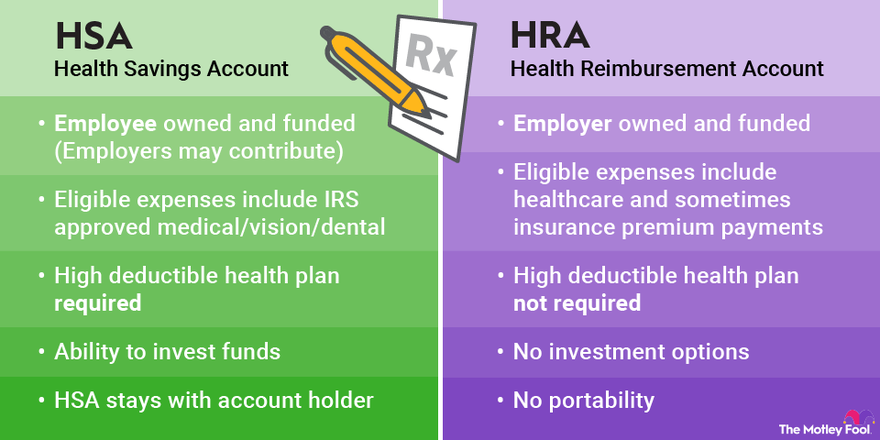

HRA vs. HSA Accounts: Compare Differences and Pros and Cons

Using HSA funds for dependents' medical expenses

- FSA or HSA Eligible Products on :: Southern Savers

- Rollin' and Savin': Use Your HSA to Buy a Daily Living Wheelchair

- Are AEDs FSA/HSA Eligible?

- 23andMe Health-Only Service - FSA & HSA Eligible (before You Buy See Important Test Info Below)

- Foot Stimulator (FSA HSA Eligible) with EMS TENS for Pain Relief

- Explore Legging (Navy) - New Dimensions Active - All Shapes & Sizes

- HangQiao Womens See Through Boho Beach Mesh Sheer Bikini Cover Up Swimwear Transparent Wide Leg High Waist Trousers Loose Pants

- Nike Brasilia Clear Training Backpack, Clear/Black ,Large : : Sports & Outdoors

- How to Wear Sweatpants

- Women's Cami Body Suit, Boody