What to do if you receive an IRS balance due notice for taxes you have already paid.- TAS

By A Mystery Man Writer

Time IRS Can Collect Tax Internal Revenue Service

Taxpayer Advocate Service: Assistance with a Notice of Deficiency - FasterCapital

Notice CP14 - TAS

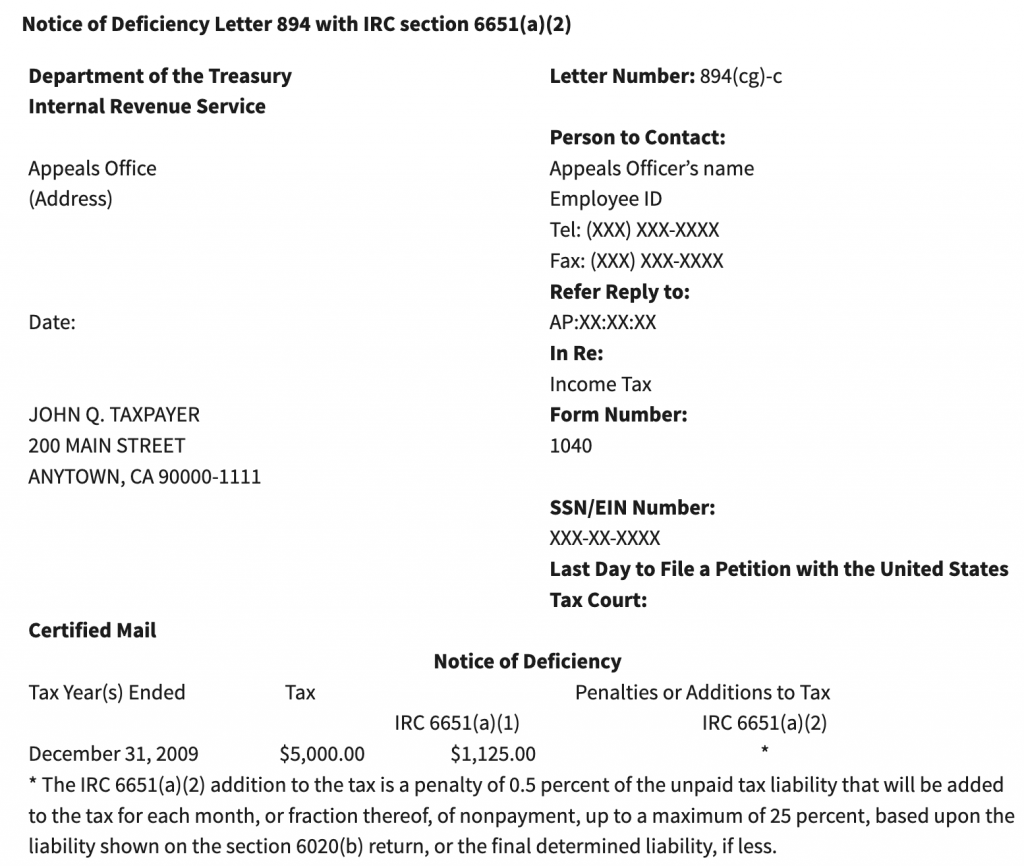

How to Respond to a Notice of Deficiency

Determining the Date of Assessment for IRS Collection Purposes - CPA Practice Advisor

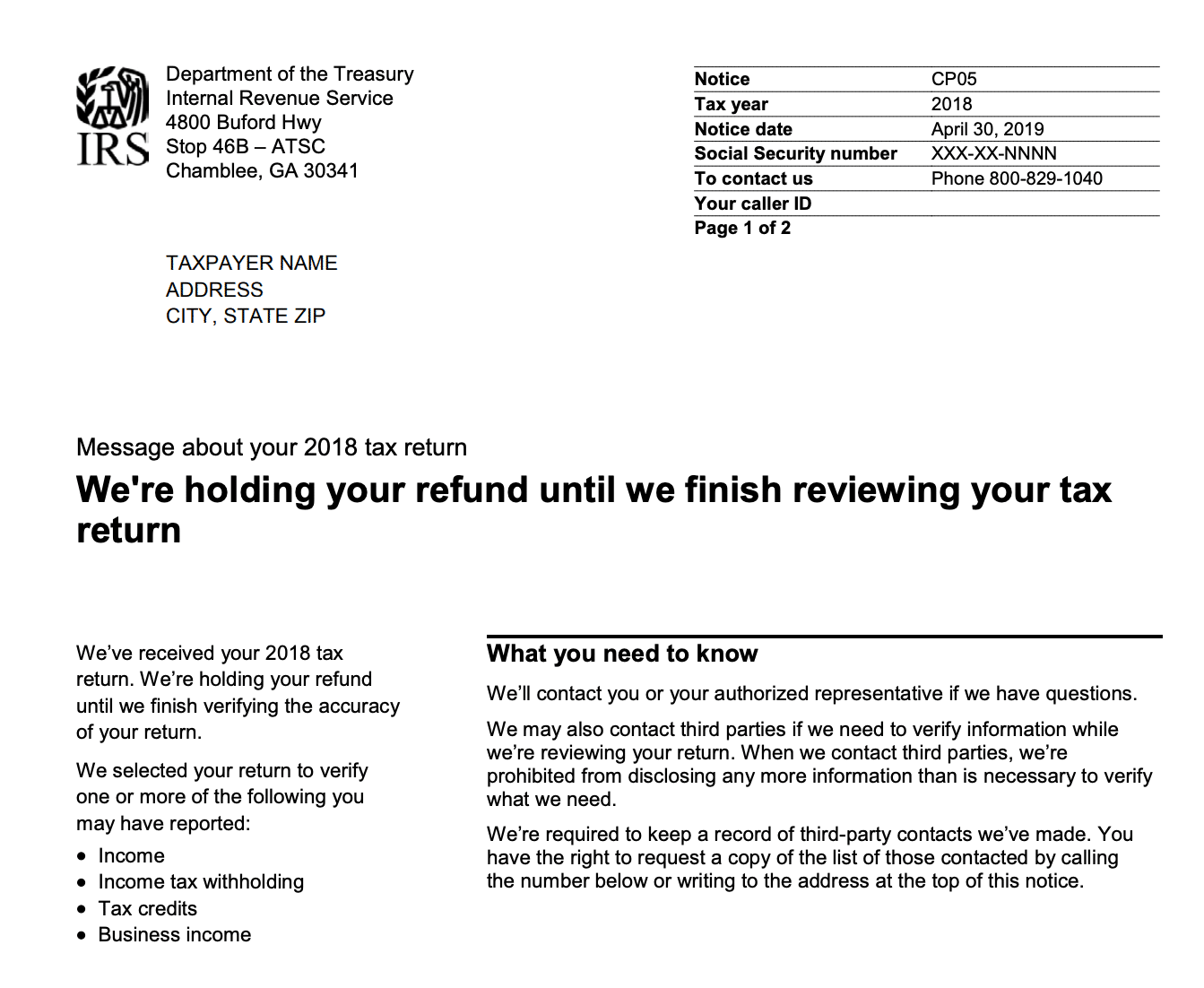

What Is a CP05 Letter from the IRS and What Should I Do?

/wp-content/uploads/20

IRS Threatens Coloradans Who Already Paid Taxes: 'They're Frightened And They Don't Understand' - CBS Colorado

Notice CP40: The IRS Has Assigned You to a Debt Collector

IRS Letter 3219: What To Do When the IRS Sends You a Notice of Deficiency - Choice Tax Relief

IRS to resume sending suspended tax notices - Don't Mess With Taxes

How to Contact the IRS (Online, by Phone, or in Person)

- Check if you have local admin rights to install Office - Microsoft Support

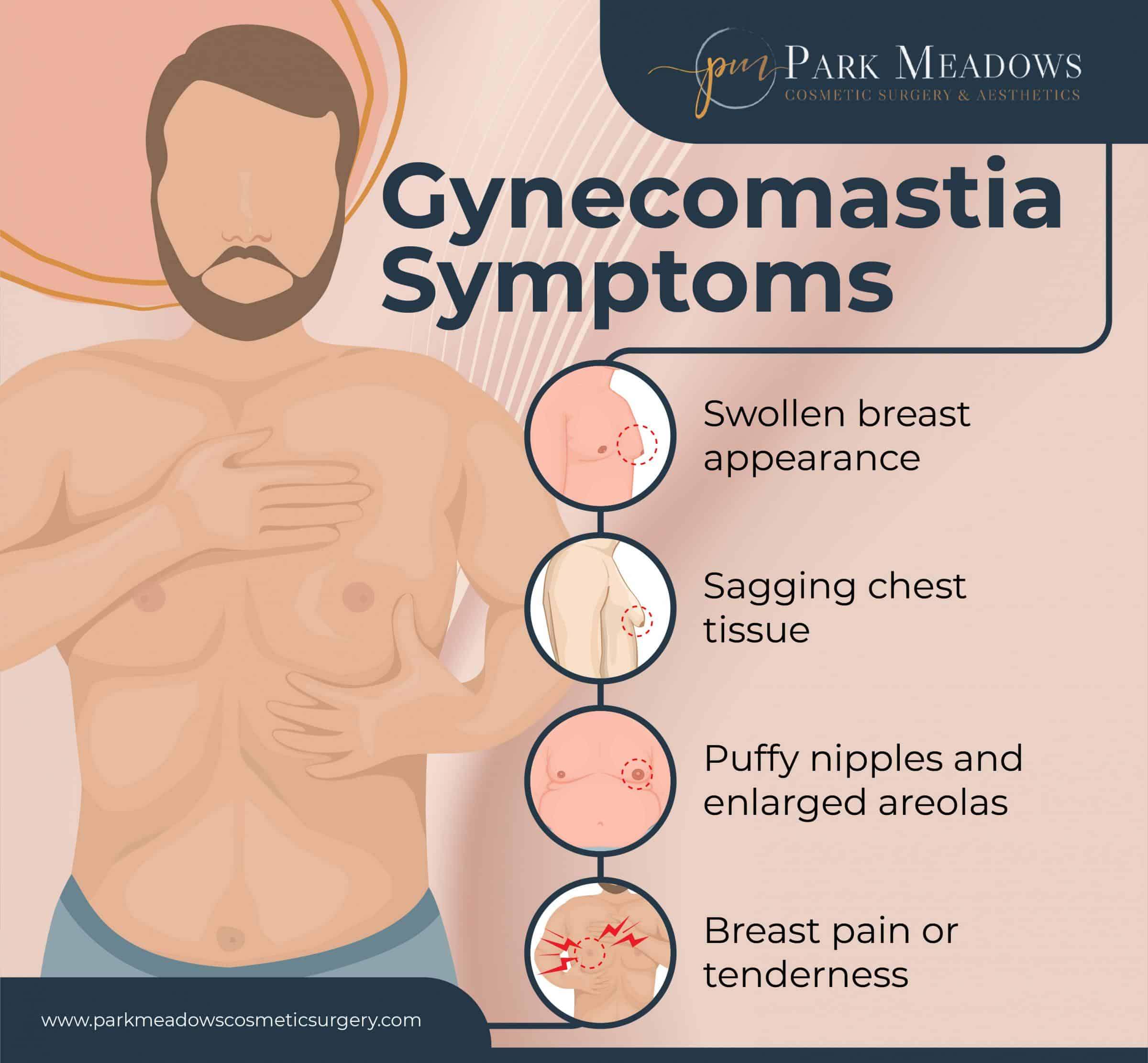

- How To Tell if You Have Gynecomastia - Park Meadows Cosmetic Surgery

- How To Know If You Have Gingivitis? - Dr.quadri Clinic

- Can You Eat Salt If You Have High Blood Pressure?

:max_bytes(150000):strip_icc()/can-you-eat-salt-if-you-have-high-blood-pressure-b3390a3864dd45cb92eecc3a62a47b24.jpg)

- If You Have Coronavirus Symptoms, Assume You Have the Illness, Even if You Test Negative - The New York Times

- 4pcs Girls Bra Cotton Vest Bra Full Cup Breathable Bra With Chest

- Spider-Gwen aka Ghost Spider! 🕷️- 2023. It's been agess since I drew a comic character fanart 😮 I really love the style of the

- High-Waisted PowerSoft 7/8 Shine Leggings

- Girlfriend Collective Compressive Pocket Legging (28.5 Inseam), Black, M

- How is a Haute Couture dress made? 7 steps to know